Simple, frugal living in today’s modern world is still possible with these budget ideas and money-saving tips for your family. The old-fashioned pioneer life has its place in this fast paced society of technology. Read on to learn more!

Note: This blog post has been updated to include multiple podcast episodes on frugal living. Over the years, I’ve had multiple listeners ask for ways to live more frugally, so download each of these podcasts and listen to them at your leisure! Here’s to frugal living!

Listen to the full episodes of the Pioneering Today Podcast, where we don’t just inspire you but give you the clear steps to create the homegrown garden, pantry, kitchen and life you want for your family and homestead:

Frugal Living Homestead Style

Living frugally with essential homestead skills is more important than ever these days with the rising cost of inflation. It seems grocery prices increase before I make it through the store aisles. Loading a few meager bags of food into the car costs a pretty penny; it’s disheartening.

I have been taking into account the stories shared with me about the steps to a simple life our great-grandparents knew and things our grandparents reused during the Great Depression so I can make two ends meet for our family as a modern homesteader.

Frugal living is learned; believe me, I have learned through trial and error over the years. Putting into practice the tips to live like the Pioneers and staying consistent has its challenges, but at the end of the day, it’s been well worth the long-term investment of time and energy. Homesteading can really save you money.

Common Financial Mistakes

Not Keeping an Accurate Budget

Chris points out that we all would love to be great mental accountants. The truth is that the majority of us generally underestimate what we spend and overestimate what we save.

We must keep account of what we’re spending and saving and check in with it at least once a week.

Saving Money While Getting Out of Debt

The common mistake here is thinking that you can’t save money while also getting out of debt. Though this can be difficult to balance, it is possible to do. While it may take longer, the snowball effect is real. But patience is key!

Chris recommends getting an emergency fund first; this will act as a cushion should you come up against a financial hardship. Once you have a couple thousand dollars in the bank, you can then start tackling that debt.

Chris’ recommendation for tackling debt is to pay the minimum on all debts while throwing extra toward the debt with the highest interest rate. Once that is paid off, all extra money goes toward the next debt in line.

Budgeting for Fluctuating Cash Flow

Many homesteaders have seasonal income, and not budgeting according to that fluctuating cash flow can get you into a lot of trouble or force you to take on debt.

Figure out what your cash flow looks like throughout the year. On the months when income is higher, tuck some of that income away into a savings account. Then, when income is lower, you can dip into that savings account to make ends meet.

Getting Overwhelmed

When we get overwhelmed by debt, it can be easy to ignore it and not do anything about it. Or, sometimes we can get to a point where we just live with debt as part of life.

It seems counterintuitive, but paying closer attention to your debt and having a plan to get it under control actually helps that feeling of overwhelm go away because you’re taking control of the situation.

Even small steps toward eliminating debt can help that feeling of overwhelm diminish.

Know the Costs to Cut Costs

Whenever we’re thinking about making a financial investment on the homestead, it’s so important for us to completely understand the cost. Just because eggs are at an all-time high doesn’t mean it’s financially smart to go invest in our own egg-laying chickens.

There is more cost than just the chicken! You have to consider the coop, the feed, and the equipment needed to raise backyard chickens. What will it cost you to get that first dozen eggs?

In the long run, raising chickens for eggs does save money, but it will take a while before you’re recouping that investment. So it’s extremely important to know if your budget can afford that upfront cost!

Not Getting a Financial Advisor

Having someone to go to for questions about getting out of debt, saving for the future, investing in retirement, etc. is so important. By not getting one, you run the risk of making costly mistakes for your future retirement plans.

This is especially important if you’d like to create a will or leave a generational legacy for your children. You want to make sure that your plans are written out and legal! So Chris highly recommends finding someone who can hold your hand and walk you through it.

Tips for Living Frugally

The little things in life go a long way when living frugally in the Pioneer spirit on the homestead, or anywhere for that matter. I have learned and used many tips and tricks to keep our household running well, experiencing the frugal Pioneer lifestyle we have chosen.

Make a Budget

I was raised in a frugal household. My parents were taught by their parents, and it was all I knew. I learned that making a budget is intentional and, if held to consistently, will guide you with your spending. Living outside your budget is where things can get out of balance quickly.

Keeping your budget honest and realistic is important because your life and household are what your budget manages. Couponing and sales can only get you so far; you have to ask yourself if the purchase is a need-need or a want-need and wait for a bit before making the final purchase.

Making sure you have a margin for the unexpected things that come up, or extra monies needed for gift buying, repairs, travel or the occasional unforeseen expenses is real life. We try to make sure that the miscellaneous amount is realistic and affordable.

Spending Freeze

Don’t put a freeze on your monthly bills and necessities. Pay your mortgage, electric bill, phone bill, and credit card payments. Homeless, cold and hungry is a terrible place to be, and that’s not the freeze I’m talking about here; it’s a spending freeze!

For example, I am talking about freezing your spending at the grocery store. Purchasing bread, milk and eggs if you don’t have a cow and chickens is a place you wouldn’t freeze. Buy only the absolute necessities and make do with what you’ve got. You’ll save and use what you have.

Try using what’s in your pantry, freezer and household and use up some of the items you have. Sometimes, I am amazed at what I have on hand that was pushed to the back of the freezer and made a substantial meal with leftovers.

Get creative and see how far you can go with what you have. My frugal living tips for making homemade meals with food in the pantry and freezer are far better than spending on convenience foods, increasing your grocery bill.

Sell Things You Don’t Need

Going through my house, outbuildings, garage and other areas on the homestead help me de-clutter and purge stuff I don’t use or need anymore. Selling some of these items adds a little money to the budget; it’s encouraging to have money flow coming in and not out all the time.

My rules for bartering success offer tips to live a more frugal lifestyle. Trading something you don’t need or use anymore for an item you could use keeps you from spending money and lightens that footprint on our shared planet.

A lot of budgeting is about being frugal, but sometimes you’re already on so tight of a budget you can’t cut any more corners. So this gives us a way to bring extra money into the budget.

Don’t Buy Things You Don’t Need

Remember which things are necessary and which are only luxuries. Even after the Great Depression was over and my grandparents had some money, my grandma was still in the mindset you didn’t splurge on things.

My dad told me a story about my great-grandpa going to the store and buying great-grandma a hand mixer. She made him return it and said, “I don’t need that; I can do without it.” So much of what we have we don’t need.

I will do some shopping online because we live in a rural area, and I can only sometimes get to the store. I’ve started putting things in the cart and waiting to check out immediately. I will come back the next day, and usually, I find I don’t need it and end up not purchasing it.

Pro-Tip: Periodically review your memberships and streaming services to validate that they are bringing value to your home. If not, cancel them!

Reuse and Repurpose What You Can

When I reuse or repurpose things, I feel like I live an old-fashioned pioneer life. This frugal way of life inspires me to think about what I can do to leave a lighter footprint on the planet.

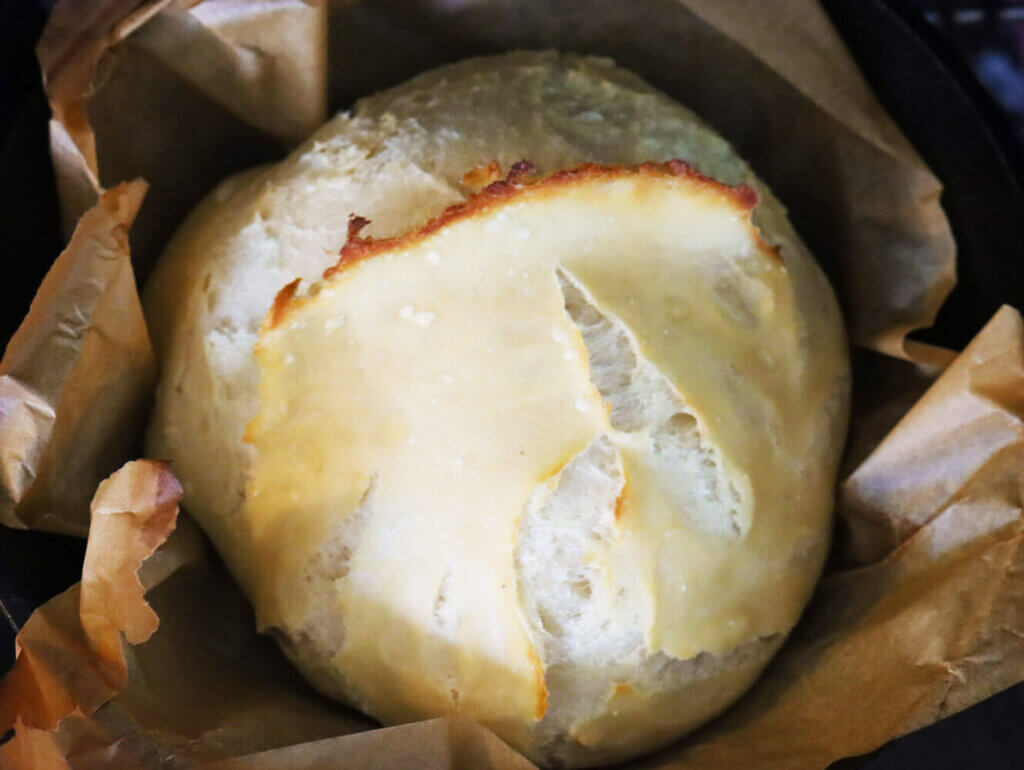

In the kitchen, you can reuse plastic bags, wash and turn them inside out to dry and reuse them multiple times. (Or grab some of my Pioneering Today linen bread bags!) Parchment paper is not a one-time use either. When I make homemade no-knead artisan bread or granola bars, I can use it 2-3 times before throwing it away.

Learning a few sewing skills goes a long way when repurposing or making new items out of old things. Sewing is not something I do well, but having a seam ripper (what a lifesaver for me) and a few simple sewing skills can really go far when it comes to living frugally.

Ma from the Little House on the Prairie series inspired me to consider repurposing clothing. These DYI repurposed sweater projects can show you how to turn two old sweaters into a hat, fingerless gloves, a scarf, and two sets of boot socks.

You can also take quilting to a new level. The Pioneers did quilting because it allowed them to take smaller bits of fabric and turn it into something beautiful and valuable. Quilt making is an excellent way to use scrap clothing while keeping you cozy and decorating your home.

Make What You Can Yourself

My grandmother always said you can make anything at home. She firmly believed everything made at home is better for you than store-bought.

We’ve come full circle and are embracing this way of life again. Making homemade all-purpose cleaners and homemade foods is cheaper than buying them in the store, and it’s healthier.

There are frugal ways to prepare food thoughtfully, like in the days of the Great Depression. My dad remembers eating biscuits and cornbread (no yeast required) with homemade jam and applesauce because store-bought was too expensive.

I still make strawberry jam, blueberry jam, and cherry jam recipes without store-bought pectin. You could say I take after my grandmother in many ways. I look for ways to be frugal and creative to stretch our household food budget and eat healthy, homemade food.

My great grandma’s pie crust only took a few ingredients and was used for sweet and savory pies, filled with what they had available. Grandma would make pasties from her pie crusts, cutting out small circles and filling them with fruits, meats, and veggies. Delicious and filling!

Being a picky eater wasn’t an option, and treats were far and in between.

You had to be creative, and my great-grandma made a treat my dad and aunt fondly remember called chocolate gravy. They had it over flaky buttermilk biscuits; Dad said it was delicious and filling. Creativity creates memories!

Grow Your Own Food and Feed for Animals

Living a pioneer homesteading lifestyle and raising whole foods causes us to pay attention to what we need and can afford, not what we want. We grow and make foods that are good for our health using different preservation methods, like fermentation, canning and dehydrating foods.

Corn is usually easier to grow than wheat, at least where we live. You go through your corn, pick the ears that aren’t prime, cut the kernels off the cob, and dry them. When fully dry, make it into corn meal to feed livestock in winter. Every little bit helps with the budget!

Save as Much as Possible in the Summer

Having a garden in the summer can help with frugal living by storing up as much as you can for the other months of the year. Starting with a small garden or container gardening is a great way to experience gardening and add food to your pantry.

Canning, freezing, fermenting and dehydrating foods stretch your food budget, and it’s a healthier way to eat. If you are new to canning, check out my free canning video series to get started.

Farmer’s markets and co-ops are readily available in most areas if a garden isn’t something you can have. Local farms grow extra foods to sell, and often, it’s organic. Either way, it is a frugal pioneer way to store healthier foods for your household.

Find Multiple Uses for What You Have

Old-fashioned pioneer methods accomplish various tasks that we’ve forgotten. Take dehydrating food, for example; nowadays, we purchase the latest, greatest electric dehydrator and do not think about using heat from a wood stove or the sun to dry food.

My grandpa used a wood stove for heat, cooking, and as a dehydrator. They didn’t have dehydrators like we do now, so they used the sun or the wood stove. He hung hooks above the wood stove and used screens to dry prunes and other fruits.

Finding multiple uses for what we have takes some research, such as our local library, the internet and elders who have lived a more self-sufficient lifestyle. This research gives us access to knowledge and teaches us the ways of old for a more self-sustaining and frugal lifestyle today.

Use Things Until They Are Worn Out

I try to buy things of good quality and take care of them. Frugality does not mean purchasing the cheapest item. You can spend a few more dollars and have better quality items that stand the test of time, saving you money.

We get what we pay for when we use cheap items made of cheap materials that fall apart quickly. Spending money on a higher-quality item and taking good care of it can stretch your dollars further in the long run.

Clothing, for example, is an area we as a society fail miserably. We are all guilty of keeping clothing until we don’t like it or want it anymore because it’s no longer fashionable.

The Depression Era mindset was about finding ways to use things repeatedly. They often purchased their clothes used, even after the Depression was over. We live in a throwaway society, yet reusing items until they are worn out is an easy change.

Just step into your local thrift stores and see all the clothing, shoes and household stuff that is barely used and ready for more wear. It will be a significant savings for you and make good use of items that would otherwise fill our landfills.

Or, when your clothing or sheets wear out, cut them up and use them as dish towels or emergency “spill” rags.

Buy on Sale and in Bulk

These tips for buying food in bulk show you how to buy quality food in quantity that will store well in your pantry at a huge savings. Buying in bulk allows for batch cooking and freezer meals and increases your options to make baked goodies and other holiday food gifts for multiple people, all while staying within your budget.

You can buy items on closeout for quick sale and use them for multiple purposes. I have a weakness for sales and clearance items and know that I can blow the budget if I don’t think through what I’m purchasing. Make a list before buying so it doesn’t go to waste.

Impulse buying happens when you see a good deal and purchase multiple budget-breaking items that don’t get used. It’s a checks and balances method that requires self-control and practice. Patience is needed because there is always a good deal around the corner.

Learn Your History

Lastly, I would encourage you to talk to your family and get your family history, stories, and recipes before they’re gone (like the pumpkin roll pictured above!). Reach out and ask questions; ask them for recipes and stories. I feel blessed to connect with my family and preserve this knowledge before it’s forgotten and gone.

Nowadays, a cell phone is a mini handheld computer that allows you to conveniently research your family’s heritage or keep videos of a family member’s stories and experiences. We can keep our families history and pass it on to our children, so they continue to learn from their ancestors.

Resources

- Podcast #460

- Find Chris at Popcorn Finance

- YouTube

- Chris’ Podcast, Popcorn Finance

- Podcast #40

- One Thousand Gifts by Ann Voskamp

- Podcast #47

- Find Ruth at Living Well Spending Less

- Ruth’s Book Living Well Spending Less

- Verse of the Week – Hebrews 12:1

- Podcast #71 – 5 Frugal Tips from Ma Ingalls and the Pioneers

Other Articles You May Enjoy

- 5 Reasons to Use a Clothesline

- 7 Frugal Fall Recipes for Real Food Kitchens

- 10 Things Our Grandparents Reused During the Great Depression

- 6 Tips on Buying Food in Bulk

- 6 Rules for Bartering Success

- 8 Tips to Live Like the Pioneers

- 13 Steps to the Simple Life Your Great-Grandparents Knew

- Essential Homestead Skills

This post is a fantastic reminder of the resourcefulness displayed during the Great Depression. I love the practical tips you’ve shared! It’s amazing how those old-fashioned strategies can still be relevant today. I’m definitely going to implement some of these ideas to help stretch my budget further. Thanks for the inspiration!

This post is filled with several things I had not considered. I have a wood burning stove, but I didn’t even think about using it as a dehydrator. Since I love beef jerky and it’s so expensive, this is something to consider doing.

Hi Melissa,

I think I read somewhere on this website that your father was diagnosed with Alzheimer’s disease? If I am confusing you with someone else I do apologise!

I wanted to mention three journal articles that I have read, that might be of interest.

Reversal of cognitive decline: A novel therapeutic program

Dale E. Bredesen

Aging September 2014

ReCODE: A Personalized, Targeted, Multi-Factorial Therapeutic Program for Reversal of Cognitive Decline

Rammohan V. Rao et al

Biomedicines 2021

Randomized Crossover Trial of a Modified Ketogenic Diet in Alzheimer’s Disease

Matthew C. L. Phillips et al

Alzheimer’s Research & Therapy 2021

Benfotiamine and Cognitive Decline in Alzheimer’s Disease: Results of a Randomised Placebo-Controlled Phase IIa Clinical Trial

Gary E. Gibson et al

Journal of Alzheimer’s Disease 2020

Ok that’s four studies 🙂

Dr Dale Bredesen has also written three books about his approach to Alzheimer’s, I highly recommend them.

The one concern I have with his approach is the risk of excessive weight loss. He does mention this in his second book, but perhaps doesn’t quite give the issue the attention it deserves.

Thanks for all you do!

I grew up with my Depression Era grandmother, and I have always been good about being frugal. Always good to stay on top of being frugal in every aspect that you can.

Wow, is this ever a timely blog post to be reread and shared! I think we’re all feeling the crunch of inflation, shrinkflation, and world events. There are ways to be frugal and building an ingredient pantry and learning to cook from scratch is the surest way to hedge your bets against food costs continuing to rise. Thanks for all the great tips!

Melissa, I am so glad to hear that you are feeling better! There is nothing more humbling than being down and out for that long. Thank you so much for all you do! I have learned so much from you in the last couple years! ❤️

Frugal meat tip I saw years ago, and have used for many years…I keep a container going in my kitchen freezer for bits of leftovers…pieces of meat, a bit of veggies, broth, spaghetti, you name it, it goes in there. When the container is full, we have ‘mystery soup’. It’s kind of a joke in our family, and everyone tries to guess what’s in there. Add spices, cheese, whatever to make it yummy. If there is a couple leftover meatballs or spaghetti in there, turn it into Italian mystery soup. Some potato and veggie pieces, add cheese and milk and turn it into a cream soup. It’s always different and always yummy. Especially when served with my husbands artisan sourdough bread. 🙂

Hi I have clicked on the four frugal recipes key several times and entered my email and it comes up with a thank you screen but no recipes. Am I doing something wrong?

Linda, it should deliver straight to your email. Make sure and check your spam folder. Let me know if you don’t find it there.

[…] (My husband has an aversion to farm animals. And, really, I don’t like the smell.) Read 16 Ways to Save Money & Live Frugally, advice from her great […]

Good girl, Andrea. The neighborhood, city, state, country….and let’s face it…..the world needs more people with your evaluation and determination. I am happy to find your posts.

I loved these tips. I have gathered way to much in my home. I don’t know how, because I’m way below poverty level. I need to reduce, reuse, and recycle as much as possible.

It was a joy to find your post. I’ve always wanted to live as you describe. I admire your courage and hard work. I am tied very closely to the big cities as my son is blind autistic, needs short distance travels for services he requires. I’ve done vegetable gardening forever, and adore my fun gardening as well. I would like to implement healthier foods/meals/lifestyle for my fam of 3, now that the other kids are grown and out. Limited space makes that hard, but I do have a corner lot. Bummer, most of the land is out front. Any tips you have would be great! Tish

Tish

There is a very informative YouTube channel that may help you for your front yard gardening…it is called Epic Gardening and another Epic Homestead Gardening. Kevin, the presenter, is very knowledgeable. Hope this helps!

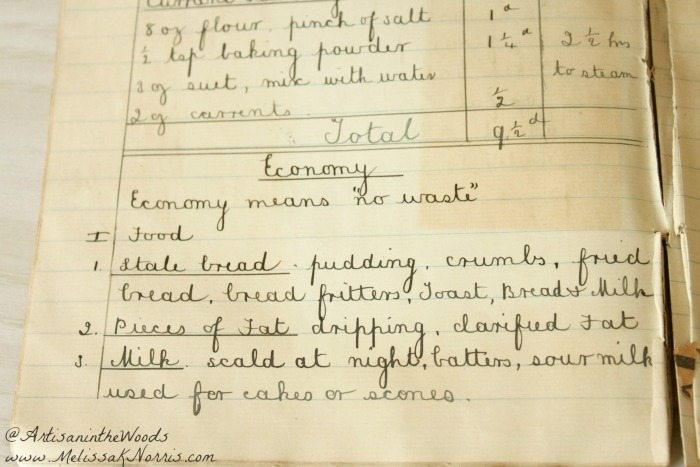

Love that beautiful handwriting! What a treasure to find and use. I too learned so much by watching my grandmother as I was growing up. She continued to live by the same standards that helped her family survive the Great Depression. I guess it was deeply ingrained by then. For me, being prepared is as much about having the skills and knowledge needed for living a self-sufficient life as the stores of supplies we keep on hand. Thanks for sharing!

Back in her day and shortly after when the Great Depression happened Cold Greens and Potatoes would have been a fabulous main meal. The greens are a protein and with the potatoes it will give you the nutrition you need.

I love to see things like this and always found ways to watch and talk to my own grandmother. She was born in 1909. Even my mom who was born in 1945 talked about how they only had “meat” once a week on Sunday’s if they were lucky and my grandmother used to talk about being embarrassed that a Preacher came around and she had Blackberry Bread for dinner and THAT is all they had.

These wonderful tidbits helped our families survive and I appreciate you sharing them with us!

Rhonda Morin

Thanks so much for sharing Rhonda, that Blackberry Bread sounds really yummy.

I really enjoyed seeing all these still valuable tips in her original hand! What a treasure, thanks for sharing

During the Great Depression they said “Use it up, wear it out, make it last, or do without!”

Great advice. Love your grandmother’s handwriting , so pretty.

Hello,

Although I am 57 (older than yourself, but you and I have similarities), I was brought-up with my Grandma, (also called Lillian) who was born in 1899. So, my Grandma lived through 2 World Wars and the Depression. We are from Yorkshire in England.

Absolutely nothing was wasted by that generation, to the extent that glass jars and bottles were sent back to the shop and cinders from the fire were recycled sometimes put back onto the fire last thing at night. The only thing thrown out was ash from the fire (actually sometimes this was used as a scourer on pots and pans and of course it was sterile) hence the term “dustbin” for what you may refer to as refuse can.

Now, bubble and squeak, so called because it “bubbles and squeaks” when cooked is a left-overs meal, likely cooked on a Monday after you have had a huge Sunday roast and really it isn’t that good to eat a big meal every day.

People have their own versions of how to cook this dish. This is how you might like to do it. In a frying pan add whatever fat you have, quite a big dollop maybe 2 to 3 ounces, add left over cooked veg eg sprouts, carrots, peas and roast potatoes. As the veg starts to fry press it down hard with a potato masher, it will ‘bubble and squeak, and brown underneath and you then turn it and brown the other side. If you are lucky it will resemble a pancake, it not it doesn’t matter. If there is left over meat slice this very thinly and place on very warm plates, drizzle over warmed left-over gravy, your meat will be warm and you serve with the bubble and squeak.

Your grandma may be referring to “Bread and Butter Pudding” which is recycled stale bread. This is actually served in restaurants!

All the best.

Sue,

Thanks so much for sharing your story and instructions on the bubbles and squeaks!

Hi Sue, My great-grandmother was born the same year – 1899, but in London. She worked in service and so never learned to cook until she immigrated to Canada and married a farmer (but she knew how to set a nice table!) Thanks so much for the bubble and squeak instructions! I will definitely be making this. When I was young, both my grandmother and mother made bread and butter pudding, although I have not made it myself. We never seem to keep bread long enough in the house to go stale! 🙂

What a treasure! And I love that perfect handwriting.

Yes, I agree that those rules are pretty much timeless. And it makes me wish that these things were taught in school now too because I feel like so many people simply never have anyone teach them these basic principles.

Lydia,

Amen! I completely agree. These are things most people used to know and so few do these days. I wish it was taught in school as well. And I’m a tad jealous of that handwriting, too. 🙂

[…] 16 Ways From 1913 To Save Money […]

I love these! I’ve just been working on a list like this uses for leftover one. Will enjoy sharing this one!

Thanks, Tessa. I just can’t get enough of old-timey wisdom either.

I LOVE Bubble & Squeak! It really does bubble and squeak when you’re cooking it.

Tricia,

Now I have to make it! I’ve actually never heard of it until Andrea wrote this article. My kids would love watching and listening to it cook.

I love the old Scottish way of cooking. I’m sure all the countries in that cluster, have awesome recipes. Neeps n tatter, cabbage anything, cock-a-leekie and my splurge, scotch eggs. These are only some of my favorites.