The high cost of inflation, rising interest rates and debt management seem to take two incomes these days to make it work. Or does it? Taking one step at a time with a good plan and commitment can help you manage your budget to learn how to live on one income. Read more here!

Listen to the full podcast, Episode #116 – 5 Tips on Cutting Your Debt Homesteading Style & My Story on Quitting My Day Job of the Pioneering Today Podcast, where we don’t just inspire you but give you the clear steps to create the homegrown garden, pantry, kitchen and life you want for your family and homestead.

Learning to Live on One Income

My husband and I have lived on a dual-income homestead for 18 years. When we decided to be a one-income family, we needed a plan. Our five homesteading skills that will save you money definitely helped, along with our ten ways to afford homesteading when you’re broke.

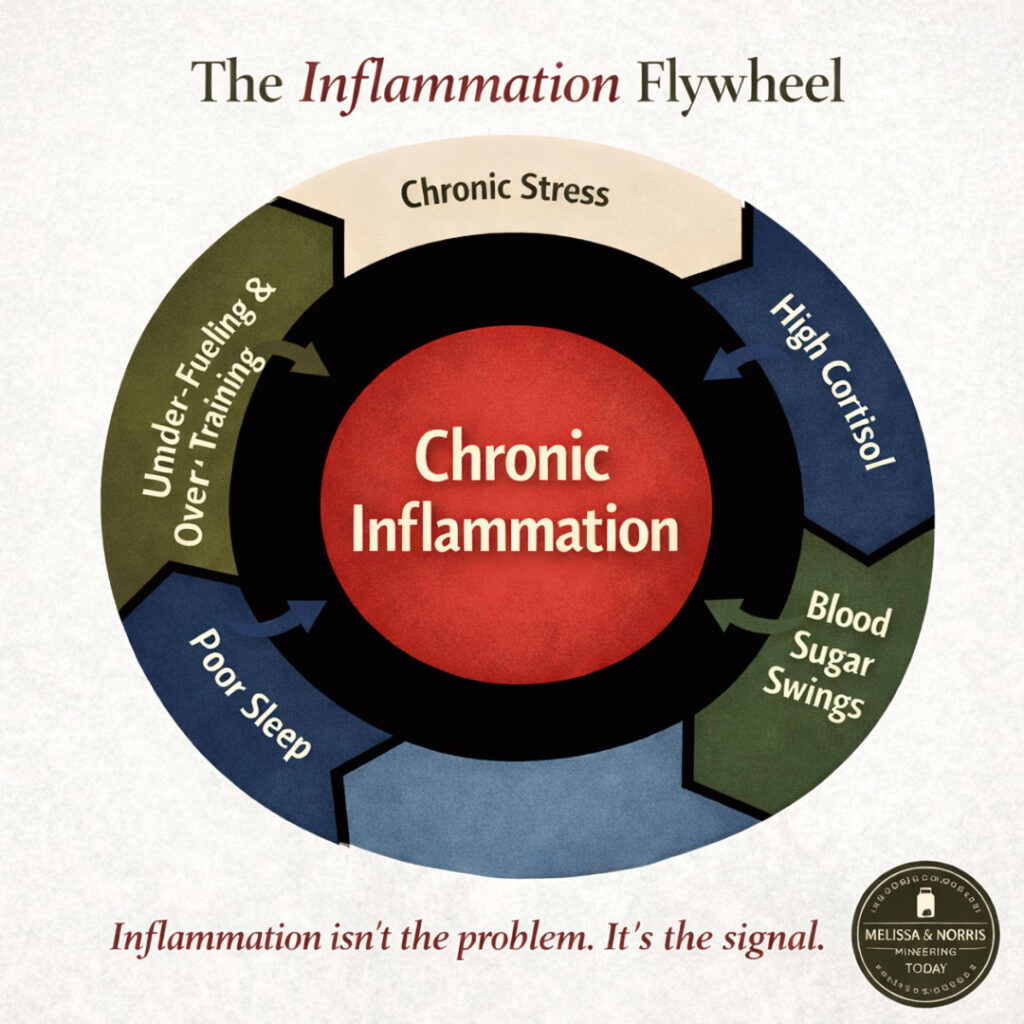

The Hidden Cycle Keeping You Inflamed

If you’ve been feeling puffy, tired, achy, or wired-but-tired, this two-page guide will help you understand what may be happening behind the scenes — even if you’re eating “healthy.”

Download the Inflammation Flywheel Guide and learn:

- Where to start so you don’t feel overwhelmed

- The 5 most common drivers that keep inflammation switched on

- Why blood sugar swings, stress, and poor sleep feed each other

I worked as a full-time pharmacy tech for over 18 years; living on a two-income budget was what we knew but wanted to change. I come from five generations of homesteaders and grew up in a single-income family, so one income was doable.

We made a good plan with a few adjustments along the way. You can read more about my story here.

We found easy ways to save money, nine money mistakes even frugal people make, and applied these four ways to make money homesteading to help implement our plan.

The self-sufficient lifestyle we love made the sacrifices worth the effort. We buckled down, learned to save money and lived frugally and kept eating the healthier food we raised and grew. Our old-fashioned pioneer lifestyle is filled with determination, sacrifice and commitment.

How to Live on One Income

You may not want to quit your day job immediately and do something else, so part-time work is a place to start. Living on a single income is a long-term commitment and doesn’t happen overnight.

Take some time to review your budget so you can manage your finances and reduce long-term, high-interest debt like a mortgage, credit card and car payments. It will get you closer to living on one income and the lifestyle you seek for your family.

These are some of the steps we took to get there, and the sacrifices have been well worth it to be a stay-at-home parent, especially with young children.

Though our children are almost grown and moved out, I do know that childcare is expensive, and being home with our kids can improve our lives.

Update Your Budget

My husband and I took a candid look at our finances and savings account and updated our budget. When you look at your budget, be mindful of everything and be honest with yourself regarding the emergency fund and incidentals, allowing margin so you don’t overspend.

I wanted to pay off debt, and we wanted to be a one-income homestead; we knew that would take time, self-discipline and commitment on all our parts. The reward would be well worth the effort once we fine-tuned the budget and started making progress.

We systematically started working on paying off our bills using Dave Ramsey’s snowball effect method. It’s a great strategy thousands have used to make a budget and get out of debt; it worked well for us.

Pay Down Debt

The snowball effect is simple and effective, a great way to whittle down your debt over time. We chose the bill we owed the least on and made an extra payment or two to pay it off.

Depending on the size of the bill and how often you can throw another payment towards it, the quicker it’s paid off. Once one bill is paid off, you take the extra monies and roll that payment amount onto the next lowest bill. One by one, little by little, it’s paid off.

Sometimes, you can’t make an entire extra payment, but adding even ten dollars towards a bill lowers the amount a little bit at a time.

You might think you are so financially strapped that you cannot make an extra payment. I get it and have been there; just be patient and look for little ways to make extra streams of income. I was pleasantly surprised at what we could do, and with some ingenuity, I’m sure you will be too.

Downsize (Sell What You Don’t Use or Need)

One of the ways to find extra money to pay off your debts is to look at what you have around your homestead that is not being used anymore and sell it. If you are downsizing, knowing how to prepare your homestead to sell will give you ample opportunity to get rid of some stuff.

Knowing how to buy a homestead and what to look for can be helpful if you decide to take on a mortgage. You will set up monthly payments at the time of purchase; if you make extra payments over the time of the loan, you can pay it off early. We took seven years off our mortgage!

Take Inventory and Use What You Have

When I did the 14-day pantry challenge with my amazing community of pioneering homesteaders, it showed me what I had on hand without purchasing more from the grocery store. The benefit of meal planning and tips for cooking from-scratch meals was so helpful.

Taking inventory of what’s on the homestead will show you more of what you can do (or sell). Look up in the attic, down in the basement, scour the outbuildings and garage if you have them. See what you have and sell what you don’t use.

Spend Time, Not Money

When we chose to really buckle down and get serious about our budget and living on one income, my time-saving tips when cooking from scratch and creating no-waste kitchen ideas helped me spend time, not money.

Spending time using our resources on our homestead to fix and repair things, along with what I believe are God-given talents, gave us the opportunities to spend time, not money, on many projects, inside and outside.

Seeing how creative you can be with what you have is very rewarding, and living on one income can be, too. Like I said, self-sufficiency, commitment and time will bring the lifestyle you’re striving for.

Resources

- Verse of the Week Psalm – 143:10

- More podcast episodes on saving money:

- Episode #59 10 Ways to Afford Homesteading When You’re Broke

- Episode #60 4 Ways to Make Money Homesteading When You’re Broke

- Episode #93 5 Homesteading Skills that Will Save You Money

Other Articles You May Enjoy

- 10 Ways to Afford Homesteading When You’re Broke

- 4 Ways to Make Money Homesteading When You’re Broke

- 5 Homesteading Skills that Will Save You Money

- Save Money & Live Frugally

- 9 Money Mistakes Even Frugal People Make

- Pantry Challenge

- How to Meal Plan 8 Tips for Easy From Scratch Meals

- Time-Saving Tips when Cooking From Scratch