Welcome! Let’s talk about money, ya know, that big old cow in the room nobody wants to talk about, especially when they’ve messed up.

Living frugally as a homesteader is more important than ever these days with the rising cost of inflation. We’re going to be talking about how to reset your budget and how resetting your budget resets so many other factors in your life.

🍞 Struggling With Sourdough?

If your starter won’t take off, your loaves are dense and hard, or sourdough just flat-out overwhelms you…

👉 I’ll show you how to fix all of it.

Join my FREE workshop and learn how to make a bubbly, active starter—the right way, from Day One.

In order for us to live this modern homesteading lifestyle, from raising our livestock for meat (feed for animals, fencing, etc.), to purchasing better ingredients on things we don’t grow ourselves, to investing in equipment to preserve food at home, we need money. While I’d love it if we didn’t, we still operate in a society that uses money.

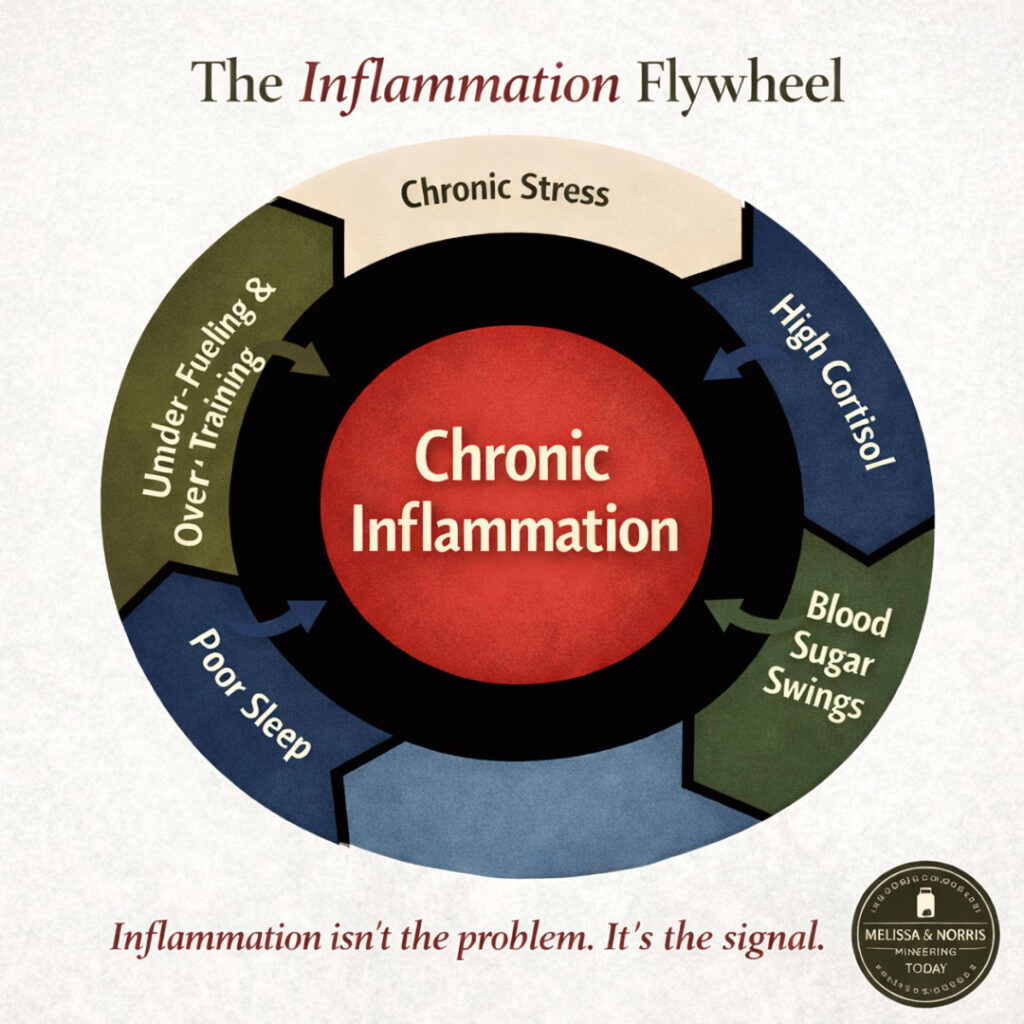

The Hidden Cycle Keeping You Inflamed

If you’ve been feeling puffy, tired, achy, or wired-but-tired, this two-page guide will help you understand what may be happening behind the scenes — even if you’re eating “healthy.”

Download the Inflammation Flywheel Guide and learn:

- Where to start so you don’t feel overwhelmed

- The 5 most common drivers that keep inflammation switched on

- Why blood sugar swings, stress, and poor sleep feed each other

Listen to this post (just push play below) and all our episodes of the

Pioneering Today Podcast while you’re on the go, scrubbing the house, cooking up dinner (can I get an invite?), or mucking out stalls! I post new episodes Friday mornings. You can subscribe via RSS and receive every episode for free.![]()

Or subscribe via Itunes

You might think having a money post on a homesteading blog seems kind of weird, but an old-fashioned skill is knowing how to manage what you have. Let’s talk about money and some of the mistakes even frugal people make. (Because these were mistakes we were making and we’re pretty frugal)

If you haven’t read this book, get yourself a copy pronto. I devoured it in a couple of days and can’t believe how much it helped us get on track, in places we didn’t even know we were off track.

Get it now–>Dave Ramsey The Total Money Makeover

9 Money Mistakes Even Frugal People Make

- Not having a true budget. Many of us use the term budget without really knowing what it means. Being on a budget isn’t simply trying to save money or purchase the less expensive item. Being on a budget means every dollar you bring in is accounted for and allotted to a bill or category. Ever heard that saying, tell your money where to go? It’s true.

- Not having it in black and white. Write it out on paper or on a spread sheet. Being an old-fashioned girl, I wrote mine out in pencil on a piece of paper. Have a column of your monthly expenses and pro-rate out those yearly fees (think Costco membership, Amazon prime, etc). Go back through your credit card statements and bank statements for automatic payments and quarterly payments.

- Not knowing your true and total debt. There’s a difference between debt and monthly bills. For example, if I don’t pay my cable bill, they’ll just shut the cable off, but if I miss a car payment or mortgage payment, I’m going to have my car or home repossessed by the bank. I’m not charged interest on expenses, but I am charged interest on debt, that’s your biggest indicator.

Don’t just go by your monthly loan payment. Call in and find out the total pay off amount due on the loan and the current life of the loan (when it will be paid off if you don’t pay anything extra). - Not separating out your expenses. I separated out our monthly bills and actual debts (loans) into two separate columns. Then, of course, how much we are bringing in as far as income goes. After all the bills and loan payments were taken away from out income, I divided every last penny into categories for groceries, entertainment, etc. Which sounds so basic and rudimentary, but I didn’t have this written out. Now I can see the debts go down as I pay them off with the money we’re saving and budgeting (because we’re truly budgeting now).

- Not knowing how much you’re actually bringing in a month on a regular basis. I put down what our average monthly income is. If we happen to get some overtime, or bonuses or extra hours for something like that, I didn’t include that in what our average income was, because it can’t be counted on every single month, but anything extra that happens to come in like that is going to go off to paying down the debt.

- Not allocating how much money you can spend in a week. You need to know how much money you have each week to spend after your set bills are paid. Not how much you think you have, but the real deal. Only spend that much.

- Not using cash. Each week, I’m going and pulling out that cash. And then, my husband and I both have that amount of cash. And if it’s gone for the week, it’s gone. If we have any extra cash left over at the end of that week, then, I’m putting it into an envelope, and then, at the end of the month, it can either go to an expense that is coming up that is not expected or in the budget.

Does this take more time? Yes. Is it really saving us money? Yes, both my husband I agree we’re much more aware of the money we spend when its cash. - Not paying attention to the little spending. What got really interesting is, my husband and I both, I make almost everything at home for our meals. We don’t eat out very often at all. Really.For school and work, we pack our lunches from home. Pretty much, we are packing our three main meals from home. Which is great. Because you save a lot of money if you make it from scratch.

And it’s usually a lot healthier. You don’t have all the preservatives in it, depending on what you’re preparing and packing. But, what I didn’t realize was how much money we were spending, and both of us, not just my husband and not just me. We both were spending money on the snack foods. Or the little extra things.

Those little things add up to bigger amounts than we think. I hadn’t added it all up, because it wasn’t an every day expense, just a few days a week. But all those little things started to add up to be a lot larger amounts than we realized. And when it’s all set down and taken into account, it’s making a huge difference. - Not calling and checking for cheaper rates of plans on a regular basis. I called into our cell phone career (we don’t have a landline) and asked them to evaluate how much of our current plan we were using. After looking at the past three months use of data, we were switched to a higher data plan (our plan was outdated) and saved $40 a month, just by asking.

If it’s been a year, do the same with your car and home insurance. Make sure you apply any savings to your current debt.

It’s amazing that just doing this one thing, resetting your budget can have so many ripple effects into other aspects of your life.

Want to learn more about making an income from your homestead or how homesteading really saves money? Join me and Anne of All Trades for this FREE training, 3 Days to Sales: How to Effectively Sell Your Product On Social Media

The easiest place we’ve found to cut back and meet budget every week is with the groceries. You can’t get much cheaper or frugal than Great Depression Era recipes or further back!! Grab our 4 favorites here-->Click here

Verse of the Week

Jesus looked at them and said, “With man this is impossible, but with God all things are possible.” Matthew 19:26

I’ve come back to this verse many times this past month. Not just with money, but with so many areas of our life, it can feel like we’ll never get somewhere. Like a situation is impossible. And often times, when we don’t bring God into it, it is impossible. But when we turn it over to Him, its amazing what He can do. He turns the impossible into the possible.